The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.

Energy saving windows tax credit 2018.

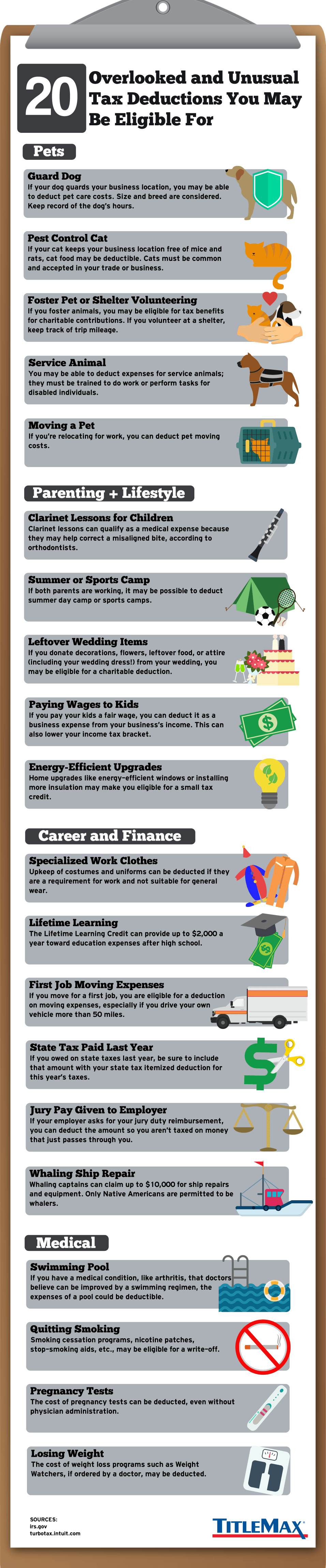

Adding insulation specifically to reduce heat loss or gain.

Part of this credit is worth 10 percent of the cost of certain qualified energy saving items added to a taxpayer s main home last year.

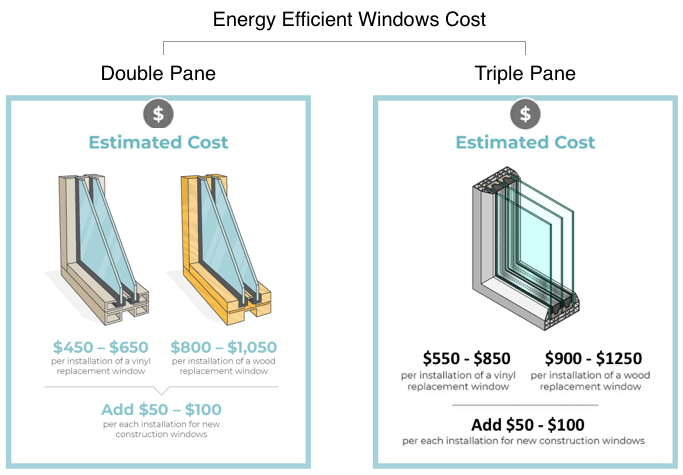

10 percent of the cost up to 200 for windows and skylights and up to 500 for doors.

Non business energy property credit.

Windows doors and skylights.

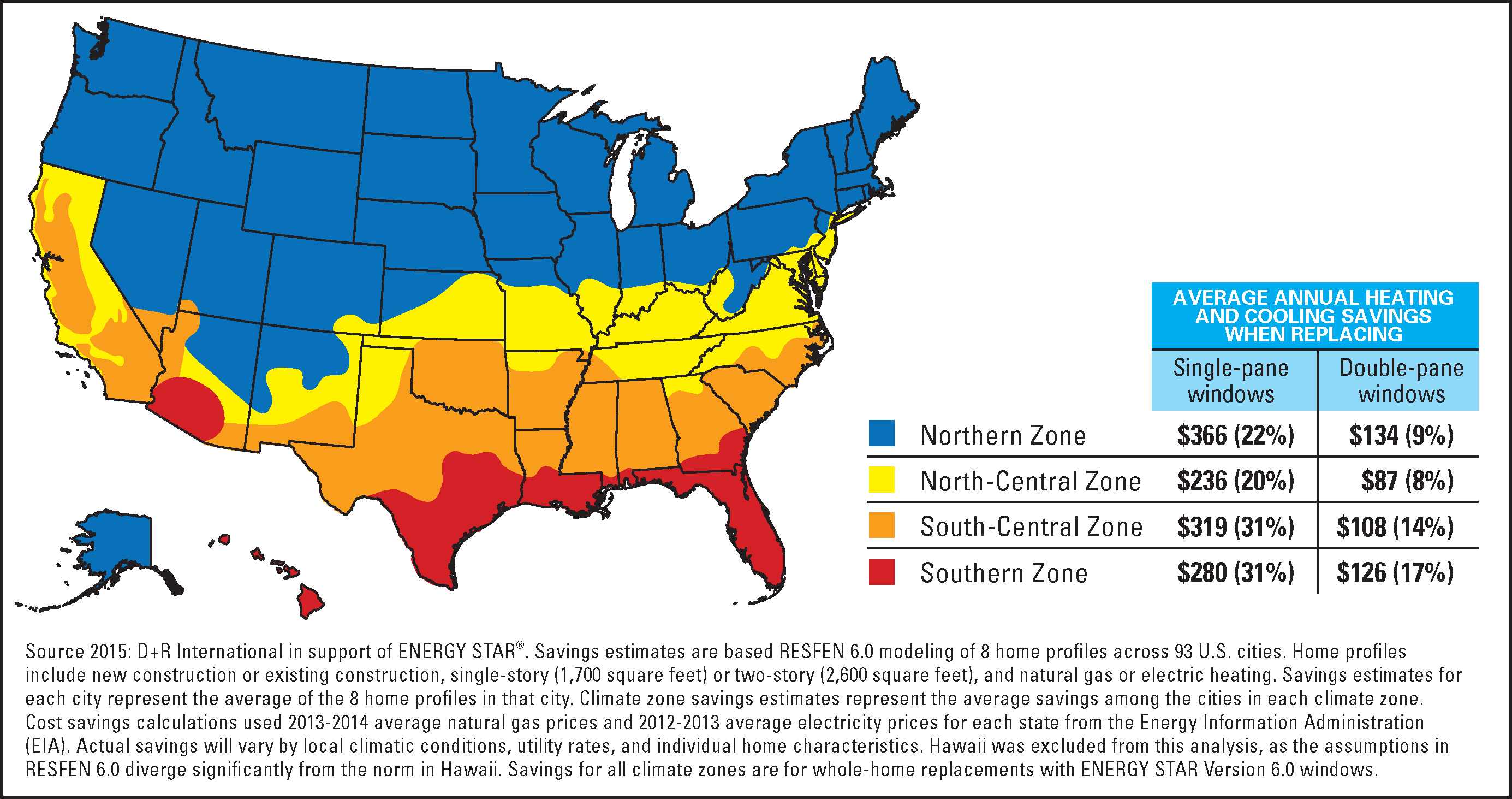

Windows doors and skylights that earn the energy star save energy improve comfort and help protect the environment.

More on saving energy.

10 of the cost up to 500 but windows are capped at 200.

This tax credit has unfortunately expired but you can still claim it for tax years prior to 2018 if you haven t filed yet or if you go back and amend a previous year s tax return.

Federal income tax credits and other incentives for energy efficiency.

Does not include installation.

The 2018 list of eligible improvements included the following.

In 2018 and 2019 the residential energy property credit is limited to an overall lifetime credit limit of 500 200 lifetime limit for windows.

Taxpayers who upgrade their homes to make use of renewable energy may be eligible for a tax credit to offset some of the costs.

Through the 2020 tax year the federal government offers the nonbusiness energy property credit.

Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020.

Upgrading to energy efficient windows skylights or exterior doors.

The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.

Not including installation requirements must be energy star certified.

Qualified improvements include adding insulation energy efficient exterior windows and doors and certain.

You may be able to take these credits if you made energy saving improvements to your principal residence during the taxable year.

The first part of this credit was worth 10 of the cost of qualified energy saving equipment or items added to a taxpayer s main home in the past year.

Purchase and install qualifying windows or patio doors that meet energy star windows program version 6 0 performance requirements beginning january 1 2018 through december 31 2020 save your sales receipt a copy of the manufacturer s certification statement and product performance nfrc ratings energy star qualification sheet with your.

Does not include installation.

If nonbusiness energy property credits are renewed for 2018 and unchanged from 2017 they could be available for certain improvements to energy efficiency.

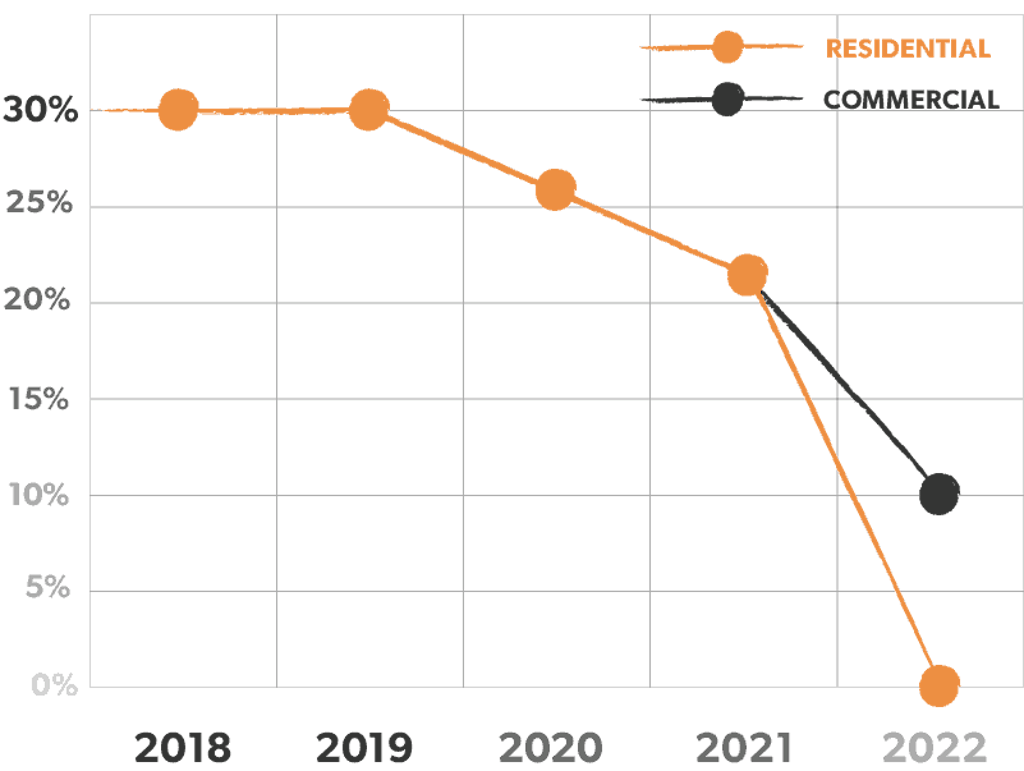

The renewable energy tax credits are good through 2019 and then are reduced each year through the end of 2021.

Claim the credits by filing form 5695 with your tax return.